If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Credits for solar panels bge.

Make the switch to solar power and take advantage of sunrun s flexible financing options and potential federal state and local tax incentives.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

Let bge home show you how installing solar panels can help you increase energy independence.

30 of the costs of equipment permits and installation can be claimed back via your federal tax return.

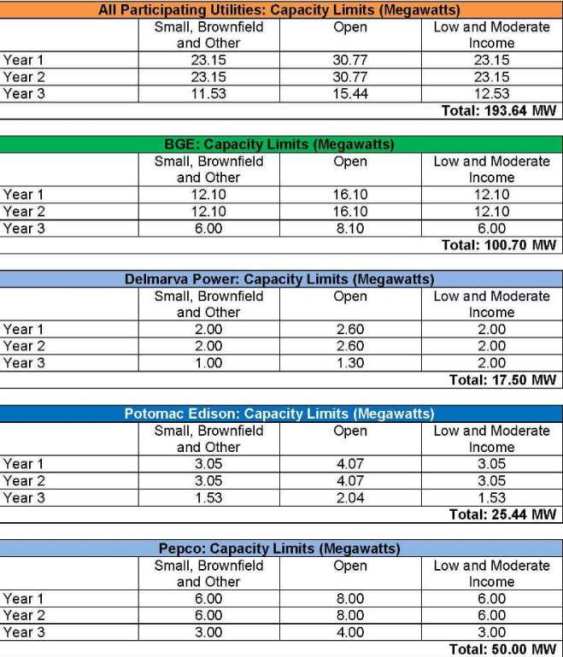

The three year community energy pilot program will.

The credit is applied to the following tax year so if you spend 10 000 on a new solar system you ll be able to take a.

If i enter the details for a bge customer that has a power bill of 230 per month into the best online solar panels calculator it tells me that i need a 12 8kw solar system that will produce 15 164 kwh s per year and that this system will likely return the owner a 101 643 profit even after repaying the capital over 25 years.

You calculate the credit on the form and then enter the result on your 1040.

To claim the credit you must file irs form 5695 as part of your tax return.

Once the subscription is purchased and the csegs is producing electricity the customer will receive a credit on their bge bill will appear on the bge bill as a community solar adjustment for their subscribed share of the csegs energy production.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

The residential energy credits are.

The federal solar energy tax credit is a tax credit that s available if you decide to install a solar system.

Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

Federal and state incentives are offered to bge customers who choose to go solar.

Filing requirements for solar credits.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

.jpg)