Photosensitive semi conductor devices including photovoltaic cells whether or not assembled in modules or made up into panels.

Custom duty on solar panels in india post gst.

Check custom duty in india import duty and import tariffs by product name or hs code from chapter 1 to 98 after gst goods and services tax.

In last year s budget the government had announced a scheme inviting companies from across the globe to set up mega manufacturing plants for different technological areas such as solar photovoltaic cells semi conductor fabrication solar electric charging.

Till now there used to be no customs duty on imported solar panels which constitute 55 of the total cost of a solar pv project.

The ministry of finance department of revenue levied the duty based on the final recommendations proposed by the directorate general of trade remedies dgtr.

The solar power sector had so far enjoyed tax exemption.

Basic import duty 10 igst 28 levy on solar inverter.

Customs import duty of solar pv panel in india customs import duty of solar pv panel under hs code 85414011 85414011.

Custom duty on solar panels in pakistan import solar product in pakistan without customs duty and sales tax.

Prime minister approves custom duty on solar panels in pakistan to promote alternate energy resources.

The government has levied safeguard duty of 25 percent on solar imports from china and malaysia.

Calculate custom duty rates through import duty calculator with your own cif value or assess value.

Solar cells whether or not assembled in modules or panels.

The federal board of revenue asked to issue necessary instructions or notification to relevant customs departments in this regard.

Solar modules contributes to 60 of the cost of solar power projects so if a 7 5 import duty is levied on solar modules it can lead to an increase in the cost of solar projects by 4 5.

Solar cells whether or not assembled in modules or panels updated india import duty and custom duty of customs tariff of 2006 2007 2008 and 2009 in single view.

The safeguard duty of 25 percent on solar modules and cells will be in force from july 30 2018.

It is recommended that customs duty be imposed on cells and modules ficci noted.

Similarly the impact of add and safeguard duty can be calculated once we know the rate of duty levied.

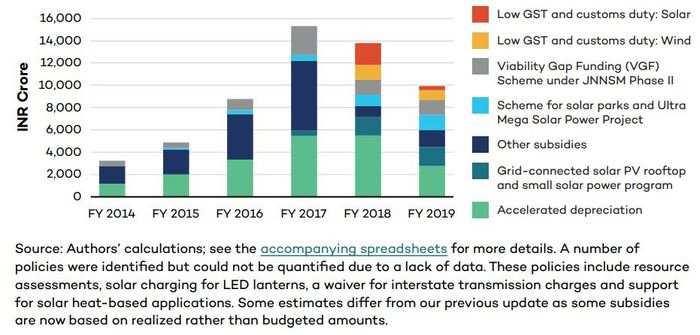

With the proposed 18 gst on solar panels the industry got apprehensive of a considerable increase in project costs.